Owning Silence in Q4

🤫 Neglected and overlooked channels deliver profitable discovery, and more!

Hey Readers 🥰

Welcome to today’s edition, bringing the latest growth stories fresh to your inbox.

And just a quick heads-up! If you stumbled upon us through a friend, make sure to subscribe below! That way, you’ll never miss out on the trending stories.

Marketers obsess over Share of Voice, the measure of how much louder you are than competitors. But this quarter, volume is the problem.

Everyone is shouting at once, CPMs are peaking, and inboxes are flooded. In times like these, winning isn’t about more noise. It’s about owning the silence.

The Q4 Auction Trap

Every Q4, CPMs skyrocket as brands chase the same audiences with the same urgency playbooks. This herd effect creates “auction gravity,” pulling costs higher across platforms.

The natural instinct is to compete harder in the same crowded zones. But at scale, that’s a losing game: higher CAC, longer payback windows, and fatigued creative.

Defining Share of Silence

If Share of Voice tells you where competitors are fighting, Share of Silence tells you where they aren’t. It’s the channels, geos, or placements that get neglected when the majority of budgets swarm Meta or TikTok during peak weeks.

Owning these quiet zones lets you acquire incremental customers at cheaper marginal cost.

Example: While beauty brands pile into Meta during Cyber Week, Pinterest often remains underfunded, despite being a discovery-heavy channel where users actively plan gift purchases.

Owning silence doesn’t mean avoiding big platforms. It means mapping where the crowd isn’t concentrated.

Silence Doesn’t Mean Irrelevance

Of course, not all quiet zones are opportunities. Some are quiet because they simply don’t convert. The art is filtering profitable silence:

- Channels where your ICP is present, but competitors are absent.

- Placements with proven creative formats (e.g., UGC video on YouTube Shorts).

- Auction prices that are materially lower than benchmark.

This is where SEMrush AdClarity becomes the precision lens. It shows you real-time competitor ad investments across channels and regions, letting you spot underfunded zones before the crowd shifts. You can start your 7-day free trial here to see which silence pockets your category is ignoring.

How to Execute

- Benchmark the Noise: Track where competitors are stacking impressions week by week.

- Identify the Silence: Pinpoint channels with minimal spend but aligned audiences.

- Test Cheap Marginals: Allocate 5–10% of spend to silence zones and track CAC payback.

- Scale if proven: Double if performance holds, pull back quickly if not.

Bottom Line

In noisy quarters, attention doesn’t scale linearly with spend. The louder everyone shouts, the less efficient each dollar becomes.

The arbitrage is in silence: finding overlooked channels and owning them before CPMs equalize. Share of Silence isn’t about being louder, it’s about being smarter with where you whisper.

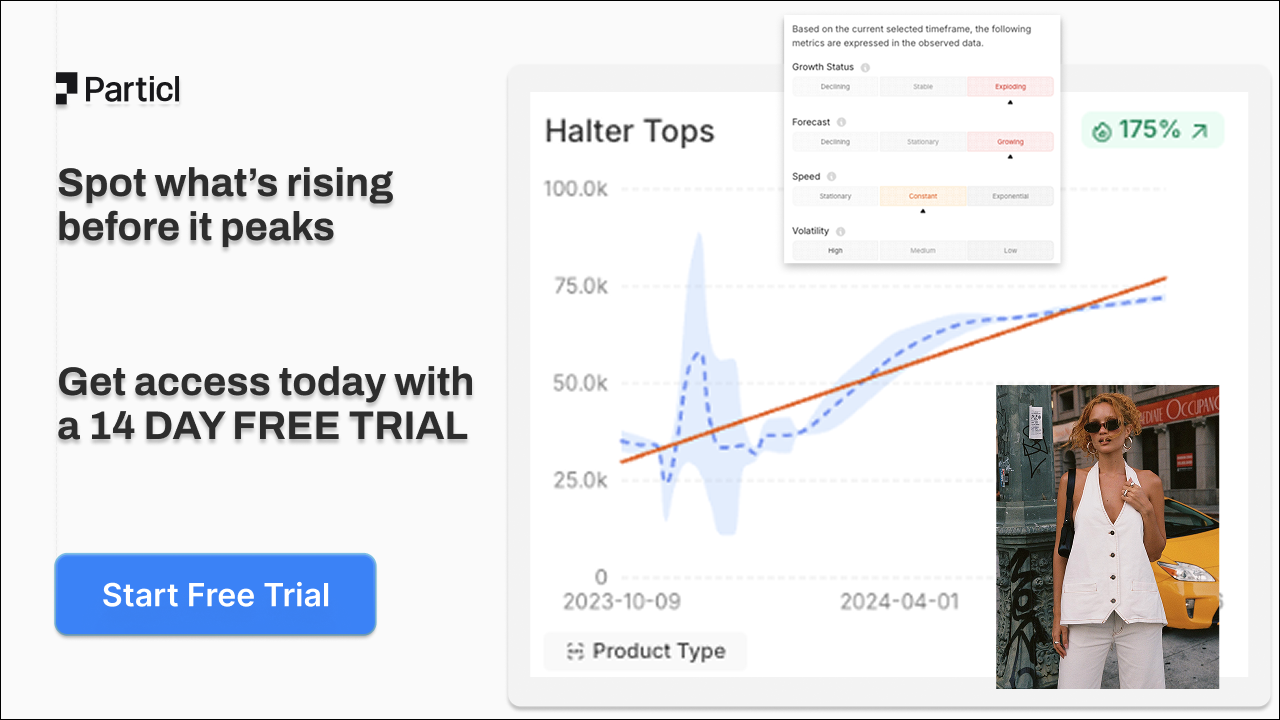

Partnership with Particl

See the Wave Before Everyone Else Rides It

Missing a trend isn’t just bad luck; it’s lost revenue. By the time most brands notice what’s rising, competitors are already running ads, filling carts, and capturing market share.

That delay costs more than sales; it leaves your entire growth strategy reactive.

With Particl’s Trends Tool, you:

📈 Spot which product categories are gaining momentum

🏷 Track keywords before they flood paid channels

👗 Identify materials, styles, and aesthetics spiking in popularity

🔍 See which companies are pulling ahead in real time

This isn’t guesswork or social media hype; it’s powered by real consumer data trusted by 10,000+ brands like Skims, Mejuri, and Vuori to anticipate demand before it’s obvious. The question is simple: will you ride the next wave, or miss it watching competitors cash in?

Start your 14-day free trial today!

🗝️ Tweet of the Day

Advertise with Us

70% of email clicks are bots but not with The Playbook. Reach real human buyers with verified clicks and only pay for actual engagement.

We'd love to hear your feedback on today's issue! Simply reply to this email and share your thoughts on how we can improve our content and format. 😍