The False Comfort of Retention Metrics

🥹What most brands miss about true repeat-purchase behavior, and more!

Hey Readers 🥰

Welcome to today’s edition, bringing the latest growth stories fresh to your inbox.

And just a quick heads-up! If you stumbled upon us through a friend, make sure to subscribe below! That way, you’ll never miss out on the trending stories.

🥹The False Comfort of Retention Metrics

Retention is one of the most dangerous metrics in DTC. Not because it’s wrong, but because it’s misunderstood. High retention in a low-purchase-velocity brand isn’t a success; it’s a stall in motion, hiding in your cohorts.

Here’s the trap:

Your 60-day repurchase curve looks “healthy” because most customers haven’t hit the window to buy again. If you’re selling wellness bundles, supplements, or even fashion pieces that naturally turn every 45–75 days, your Month 1 “retention” stat is just a function of time delay, not brand love.

And if you let that false confidence compound, it’ll inflate your LTV model, throw off your ad budgets, and mislead product expansion planning.

It’s a fake positive, and it costs real money.

Step back and segment by velocity tier

Instead of treating retention as a uniform outcome, start dissecting it by SKU-classed reorder velocity.

- Which products turn in 15 days?

- Which needs 60+ days for depletion or desire?

- Which purchases are planned repeaters vs. impulse repeats?

This recalibration alone can kill your hero illusion. The supplement SKU that looks like a rockstar in your 90-day retention graph may actually just be… untouched inventory sitting in a customer’s pantry.

⌨️ Want to build a cohort model that reflects real purchase behavior instead of false retention spikes?

Steal 60+ Claude prompts built for DTC ops, content, retention, and analytics here: Steal the Prompts for Free →

This one change fixes everything downstream

Once your retention model reflects reality:

- Winback campaigns stop targeting customers too early.

- Product teams stop interpreting demand as brand affinity.

- Finance stops forecasting LTV from delayed cycles.

You regain control of repurchase design instead of guessing behavior. You finally match retention actions to the customer’s actual timeline, not the timeline your dashboard was built to support. Because retention isn’t about who comes back.

It’s about knowing when they could come back, and who truly chose to.

Partnership with Portless

📦 BFCM is Weeks Away. Make Sure Your Inventory Isn't.

Your competitors are panicking. Their BFCM inventory is sitting on a container ship somewhere in the Pacific, arriving (maybe) by late November.

You could be selling next week.

With direct fulfillment, Portless cuts your inventory lead times by 90%, meaning you start generating cash flow immediately, not in late November.

Here's how Portless gets you selling for BFCM faster:

✈️ Onboard inventory from your factory in 1 week (not 60-90 days)

📦 Start selling immediately while others wait for containers

💰 Generate cash flow now to reinvest in BFCM marketing

🚀 Restock winners in 3-5 days throughout the entire season

With Portless, you'll be 3 months ahead of brands waiting for containers. That's 3 extra months of sales, reviews, and cash to make this the best BFCM ever.

The math is simple: Start selling your products in 1 week or wait until November.

📊 Want to start selling before your competitors even receive inventory?

Get a custom quote for your brand now →

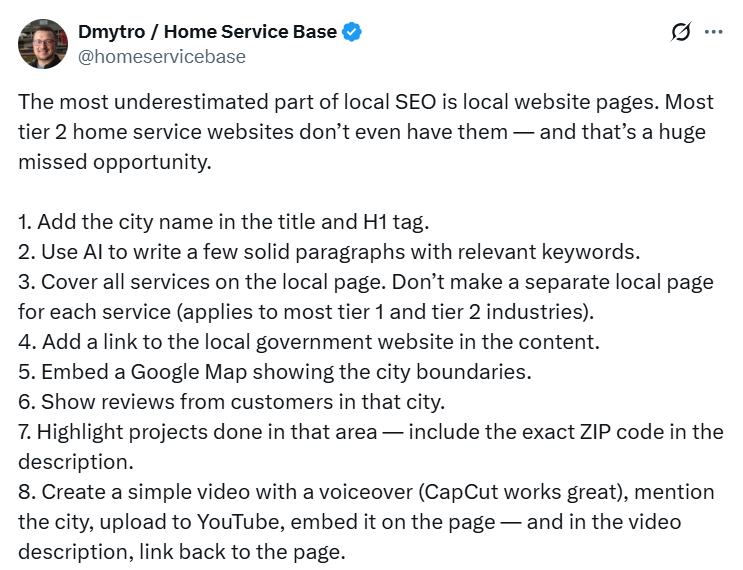

🗝️ Tweet of the Day

Advertise with Us

70% of email clicks are bots but not with The Playbook. Reach real human buyers with verified clicks and only pay for actual engagement.

We'd love to hear your feedback on today's issue! Simply reply to this email and share your thoughts on how we can improve our content and format. 😍