The Great eCommerce Fragmentation

⚡Why scale stopped being a moat, and speed became the weapon, and more!

Hey Readers 🥰

Welcome to today’s edition, bringing the latest growth stories fresh to your inbox.

And just a quick heads-up! If you stumbled upon us through a friend, make sure to subscribe below! That way, you’ll never miss out on the trending stories.

⚡ The Great Ecommerce Fragmentation

When tariffs hit, it wasn’t just supply chains that snapped. It was the illusion of stability.

The old e-commerce hierarchy, where size guaranteed survival, broke overnight. Now, the battlefield belongs to velocity brands: companies that move faster than the market can stabilize.

The Tariff Whiplash: When Agility Became the Advantage

2025’s tariff storm didn’t just dent margins; it exposed reflexes.

- Asian marketplaces like Temu and Shein saw traffic collapse by 25%.

- U.S. players like Target, CVS, and Home Depot quietly picked up the slack.

- The delta wasn’t luck. It was latency.

Velocity brands didn’t wait for clarity; they made it. They re-priced, re-allocated, and re-optimized in real time.

While giants debated forecasts, fast movers built feedback loops. That’s what speed looks like in a fragmented market, not running faster, but reacting sooner.

The New Growth Equation: Velocity > Volume

The market no longer rewards dominance. It rewards adaptability.

- Temu: +121% YoY traffic

- Target: +24%

- Amazon: –11%

The brands rising fastest aren’t the ones with the biggest budgets. They’re the ones that can pivot without approval chains.

Velocity brands live in permanent beta, shipping, testing, and learning before others notice the shift.

And according to the new Semrush × Statista Ecommerce Report, that’s now the rule, not the exception: Asian platforms lost 25% of traffic to tariffs, AI-driven shoppers surged 35×, and paid search jumped 76% YoY to become the most profitable acquisition channel.

You can get the full report here to see how these shifts are redefining speed in e-commerce.

The Regional Split: Growth Has a Zip Code Now

California, New York, and Maryland are up more than 5%. Montana, Alaska, and Maine are in decline.

The U.S. market isn’t unified anymore; it’s patchworked. Every state behaves like its own ecosystem, with unique demand rhythms and ad efficiency.

Velocity brands don’t chase national share; they hunt micro-clusters where conversion density still compounds. Geography, not category, is now the hidden growth variable.

The Motion Mindset: How Fast Brands Think

Legacy brands protect systems. Velocity brands protect momentum.

They use data as movement, not memory. Every signal, search spike, cart drop, TikTok surge, is a trigger for action. They iterate messaging daily, not quarterly. They treat volatility as infrastructure.

The Bottom Line

Market share is static. Velocity is alive. The next generation of ecommerce winners won’t be those who hold the most ground.

It’ll be those who can redraw it faster than anyone else. Because in the new commerce era, speed isn’t a metric; it’s survival.

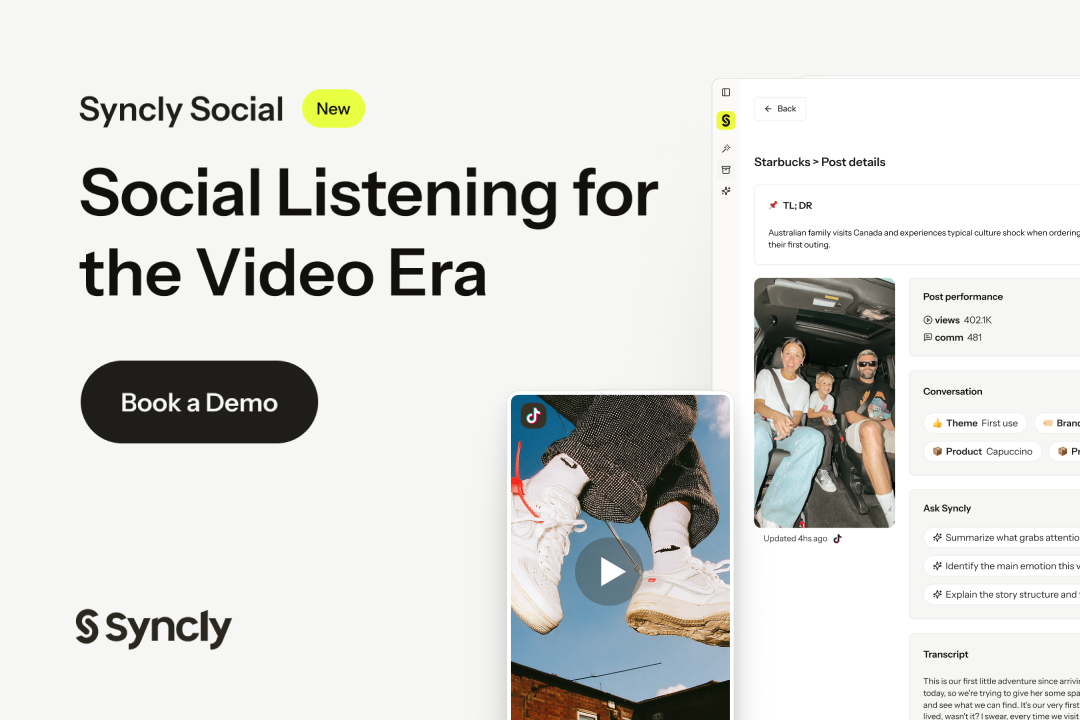

Partnership with Syncly

Your audience is talking. Can you actually hear them?

Every scroll hides a conversation shaping what people buy next. But most “social listening” tools are deaf to video, missing the real voice of your market.

Syncly Social changes that, it listens directly to TikTok videos, catching every spoken brand or product mention the moment it happens.

- Find every mention of your brand, even untagged or uncaptioned.

- Identify authentic creators already driving your narrative.

- Compare sentiment with competitors and track which videos take off.

- Filter influencers by demographics to build smarter, faster campaigns.

Top brands like Tiffany&Co, Samsung, and Adidas already use Syncly to predict what goes viral and who makes it happen.

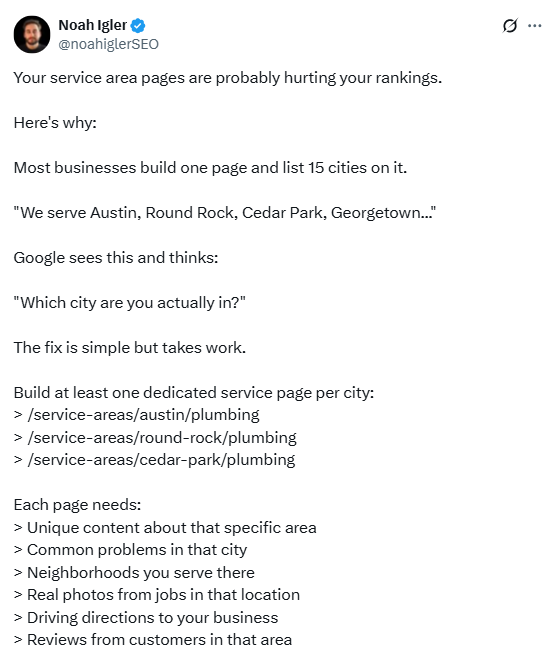

🗝️ Tweet of the Day

Advertise with Us

70% of email clicks are bots but not with The Playbook. Reach real human buyers with verified clicks and only pay for actual engagement.

We'd love to hear your feedback on today's issue! Simply reply to this email and share your thoughts on how we can improve our content and format. 😍