The Hidden Cost of Every SKU

💣 Variants create debt across creative, ops, and media, and more!

Hey Readers 🥰

Welcome to today’s edition, bringing the latest growth stories fresh to your inbox.

And just a quick heads-up! If you stumbled upon us through a friend, make sure to subscribe below! That way, you’ll never miss out on the trending stories.

💣The Hidden Cost of Every SKU

Every new flavor, size, or shade feels like growth. In reality, each SKU acts like a micro-loan against your balance sheet:

- Creative Debt: +8–12 new ad units and 3–5 PDP assets per variant.

- Media Drag: Algorithm resets lift CPMs and stalls learning.

- Ops Overhead: Safety stock, forecasting, and pick-pack complexity add 6–10% to carrying costs.

Without a clear payback path, that SKU is a margin leakage, capital that could be compounding elsewhere.

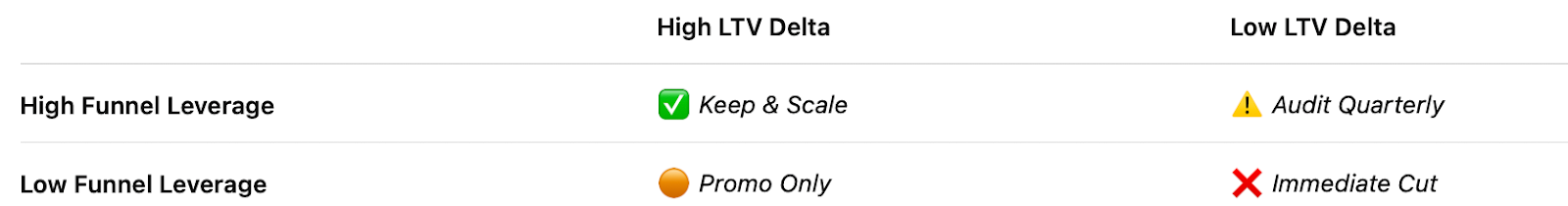

The SKU Debt Framework Visual Quadrant:

Gate Metrics for Every New SKU

- CAC payback ≤ 60 days

- AOV lift ≥ 10% and repeat rate +8% within 90 days

- At least 3 high-affinity bundle pairings

Only SKUs in the top-left quadrant get green-lit. Everything else is either seasonal or killed.

3. Competitive Intelligence, Not Guesswork

Before approval, check if competitors are overfunding the same trap.

- Run SEMrush AdClarity to map spend by SKU across Meta, TikTok, and Display.

- Compare ad spend with review velocity to spot false signals.

- Kill or delay any variant that can’t steal share or widen channel reach.

Pro Tip: Filter AdClarity by creative type and region to reveal whether rivals’ hero SKUs or side variants drive their ROAS.

4. Second-Order Financial Wins

Brands applying the SKU Debt Framework typically see:

- Cash conversion cycles are 20% faster by cutting low-turn inventory.

- Gross margin +4–6 points from simplified forecasting.

- Valuation multiple +0.5–1.0x because investors reward capital velocity.

5. Case Study: No New Product, Massive Lift

A wellness brand ignored “new flavor” requests and repackaged three core SKUs into a 21-day Reset Stack. CAC ↓ 14%, AOV ↑ 22%, Subscription conversion ↑ 33%

The SKU wasn’t new. The mechanic was.

Operator Playbook

- Quarterly Audit all SKUs through the 2×2 grid.

- Demand Hard Math: CAC payback, repeat rate, bundle lift.

- Leverage AdClarity to track competitor spend before launch.

- Scale Mechanics bundles, rituals, seasonal kits—before adding a single variant.

Bottom Line: Treat SKUs like balance-sheet assets. Launch mechanics, not noise. The SKU Debt Framework compounds LTV, accelerates cash flow, and strengthens valuation, the precise discipline top-tier operators demand.

Partnership with Shipfusion

The Post-Purchase Blind Spot That’s Costing You

Most brands obsess over the buy button, but what happens after is where they lose the most.

Shipfusion spent $8,000 ordering from 110+ cosmetics brands to test the full delivery experience. The findings are clear: if you ship to customers, this is your blind spot too.

👀Nearly 90% didn’t include free samples, and 1 in 10 went silent after order confirmation

🌀 33% of orders arrived scuffed, with over 10% containing damage.

📦 Nearly half invested in custom boxes, but just 36% branded the interior.

These numbers reveal a gap every operator should fear. You can’t win loyalty with a broken box or silence after checkout. Customers equate fulfillment with your brand, and if you fail here, no amount of marketing can save you.

The data doesn’t lie: most brands are leaking revenue and retention in plain sight. The ones who fix it now will own the customer relationship.

Grab the Cosmetics Delivery Files now and see what your brand is missing!

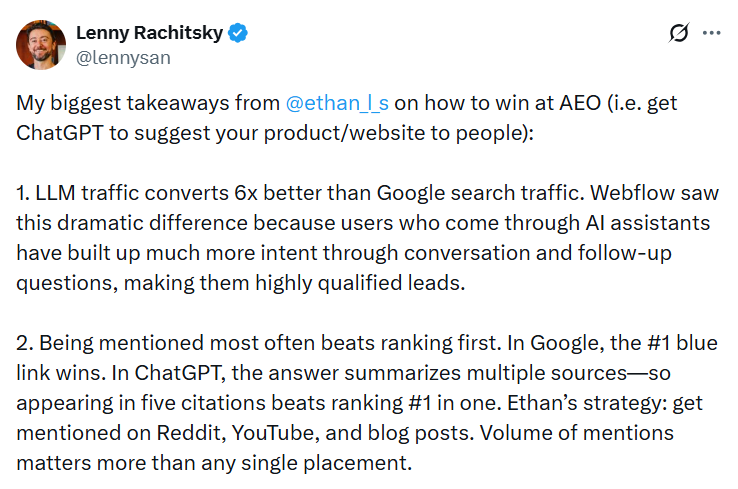

🗝️ Tweet of the Day

Advertise with Us

70% of email clicks are bots but not with The Playbook. Reach real human buyers with verified clicks and only pay for actual engagement.

We'd love to hear your feedback on today's issue! Simply reply to this email and share your thoughts on how we can improve our content and format. 😍