The Q4 Inventory Trap

📦 Don’t end up locking staggering amounts of capital in unsold goods, and more!

Hey Readers 🥰

Welcome to today’s edition, bringing the latest growth stories fresh to your inbox.

And just a quick heads-up! If you stumbled upon us through a friend, make sure to subscribe below! That way, you’ll never miss out on the trending stories.

📦 The Q4 Inventory Trap: Velocity vs. Dead Stock

Every year, eCommerce brands lock up staggering amounts of capital in unsold goods. Studies show that 20–30% of inventory typically ends up as dead stock, while overstocking alone can increase warehouse costs by 20–30%.

For DTC operators, that means Q4 “wins” often roll straight into Q1 as cashflow drag, a problem that compounds right when acquisition budgets are already under pressure.

The December Illusion of Velocity

In December, everything looks like it’s working. SKUs move faster than forecasts, dashboards flash green, and finance celebrates the spike in top-line revenue. But velocity in Q4 is often inflated by deep discounts, gifting behavior, and even resellers scooping inventory, demand that vanishes once the calendar flips.

The February Reality of Dead Stock

By February, the picture shifts. Unsold goods sit idle, capital is tied up in products no one wants at full price, and brands are forced to discount deeper to move them out. This isn’t just inventory risk; it’s working capital that could have funded Q1 campaigns, locked up in shelves instead of fueling growth.

The Hidden Variable: Fraudulent Orders

What makes this problem even sharper is how fraud and abuse distort sell-through data. Resellers often over-order hot SKUs in December and return them in January, creating artificial demand spikes that trick operators into restocking too aggressively.

This is where Chargeflow Prevent adds leverage, flagging abusive orders and suspicious post-purchase activity so your inventory signals reflect real demand, not noise. Get your first 1,000 transactions screened free!

The Operator Playbook for Balancing Risk

Don’t rely on last year’s holiday numbers blindly. Model inventory velocity as a cashflow problem, run scenarios for sell-out, overstock, and returns abuse before committing capital. Supplier flexibility, staggered reorders, and return-adjusted forecasts let you capture Q4 upside while keeping powder dry for Q1, when liquidity matters most.

The Payoff

The difference between chasing December highs and managing February reality is the difference between a brand that scrambles and one that compounds. Clean inventory data, protected from fraud distortion, gives operators confidence to move quickly without tying up unnecessary cash.

In 2025, with CAC rising and margins under pressure, the brands that treat inventory as a financial lever, not just a warehouse number, are the ones that scale.

Q4 inventory planning isn’t about chasing every sale; it’s about ensuring February isn’t your most expensive month of the year. The smartest operators know the trap and design around it before the first purchase order is even signed.

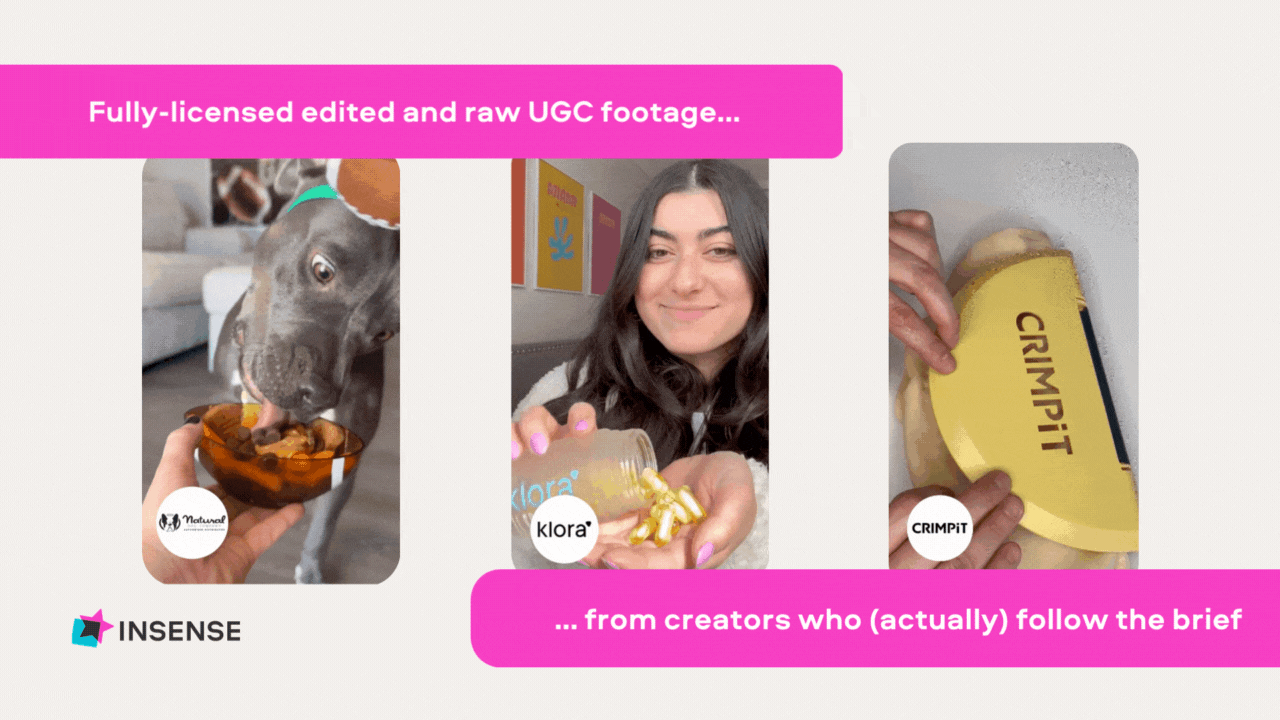

Partnership with Insense

Find your perfect influencers in 48hrs - who actually follow the brief!

UGC delivers 4× higher CTRs and 50% lower CPC than traditional ads.

But... trying to source & manage creators yourself is time-consuming.

You need Insense’s carefully vetted marketplace of 68,500+ UGC creators and micro-influencers from 35+ countries across the USA, Canada, Europe, APAC, and Latin America.

Major eComm brands are using Insense to find their perfect niche creators and run diverse end-to-end collaborations from product seeding and gifting to TikTok Shop and affiliate campaigns, and whitelisted ads.

- Quip saw an 85% influencer activation rate with product seeding

- Revolut partnered with 140+ creators for 350+ UGC assets

- Matys Health saw a 12x increase in reach through TikTok Spark Ads

Try Insense yourself.

Book a discovery call by October 3rd and get a $200 bonus for your first campaign.

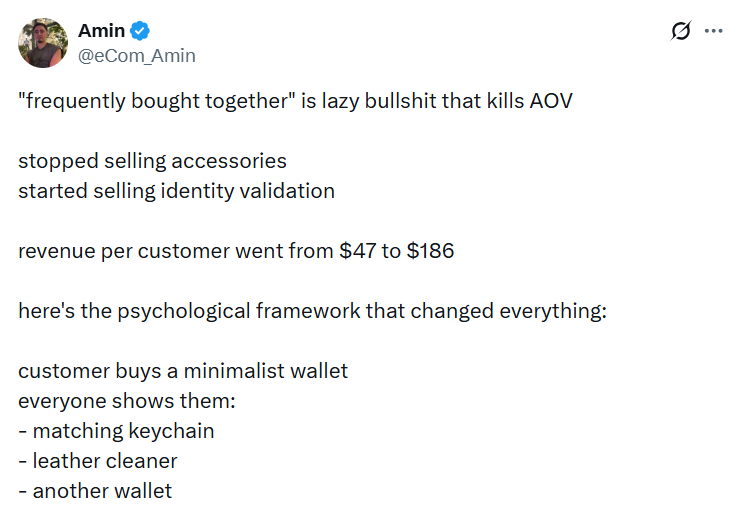

🗝️ Tweet of the Day

Advertise with Us

70% of email clicks are bots but not with The Playbook. Reach real human buyers with verified clicks and only pay for actual engagement.

We'd love to hear your feedback on today's issue! Simply reply to this email and share your thoughts on how we can improve our content and format. 😍