You Misread Your Best Customers

🧠 Why your BFCM signals collapse the moment discounts disappear, and more!

Hey Readers 🥰

Welcome to today’s edition, bringing the latest growth stories fresh to your inbox.

And just a quick heads-up! If you stumbled upon us through a friend, make sure to subscribe below! That way, you’ll never miss out on the trending stories.

🧠 Your BFCM Data Is Lying

Brands are drowning in BFCM data right now: clicks, cohorts, discount buyers, “VIPs,” first-time purchasers. But the danger isn’t in having too much data.

It’s in thinking the data is telling you something meaningful when it’s actually just telling you something specific.

And specificity is the trap.

Why BFCM Data Looks Smart But Isn’t

BFCM behaves like an AI training set with bias baked in: urgency, discounts, gifting, panic-buying, inbox overload.

If you carve out tiny segments from that noise, they may look sophisticated, but they don’t survive outside the holiday bubble. Overfitting happens the moment brands confuse abnormal behavior with identity.

How Brands Accidentally Break Their Own Signals

The problem isn’t segmentation, it’s overprecision.

Teams create segments sliced so thin they stop being representative of real customers and start reflecting holiday conditions instead.Then January comes, those segments collapse, and the team assumes retention is broken when really the model was broken.

The Shift: Think Like a Model That Needs to Generalize

Machine-learning models win when they identify patterns that hold up in unfamiliar conditions.

Q1 is that unfamiliar condition.

The brands that do well don’t ask “Who bought during BFCM?” they ask “Which behaviors will reappear when the discounts disappear?”

So What Should You Actually Extract From BFCM?

Not micro-patterns. Not cute niche segments. Not ultra-granular clustering.

The only insights worth carrying into Q1 are the ones rooted in durable behavior:

- Who buys quickly vs. slowly

- Who buys for themselves vs. for gifting

- Who buys on discount vs. without one

- Who buys bundles vs. single units

These generalize. They aren’t artifacts of chaos.

Why This Matters for Q1 Segmentation

If you treat BFCM like a normal buying window, you will misread your customers and misbuild your segments. If you overfit your lists, you will plan retention on behaviors that won’t repeat until next November.

But if you extract broad, stable patterns, not overfit patterns, your Q1 campaigns will speak to who your customers actually are, not who they temporarily became under promotion pressure.

Partnership with Insense

HACK: Get 20+ ad variations (per creator) to scale your Q5 ads effortlessly

With Black Friday behind us, it’s officially the scramble phase, the part of Q5 where performance depends entirely on how quickly you can ship fresh creatives.

There’s still time to source fresh content - and Insense makes UGC ads insanely cost-effective.

With Insense, each collab gives you a full bank of raw footage you can mix, match, and turn into multiple scroll-stopping ads. One creator can fuel an entire round of Q5 testing without draining your team’s bandwidth.

- 20+ raw assets per creator you can spin into countless variations.

- Fast 14-day turnaround so you stay ahead of Q5 spend.

- Lifetime usage rights, so every winning asset keeps paying off.

That’s how over 2000+ brands like Beauty Pie, Bones Coffee, Flo Health, and Chomps scale UGC without killing team bandwidth.

Cost-effective UGC with lifetime usage rights? Yes please!!

Book a free strategy call by December 12th and get $200 for your first campaign!

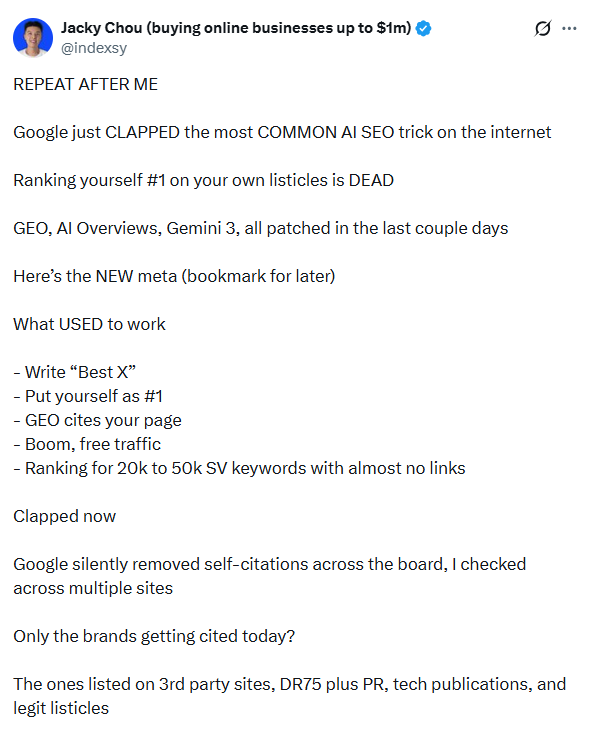

🗝️ Tweet of the Day

Advertise with Us

70% of email clicks are bots but not with The Playbook. Reach real human buyers with verified clicks and only pay for actual engagement.

We'd love to hear your feedback on today's issue! Simply reply to this email and share your thoughts on how we can improve our content and format. 😍